M-CRIL

inclusive microeconomics

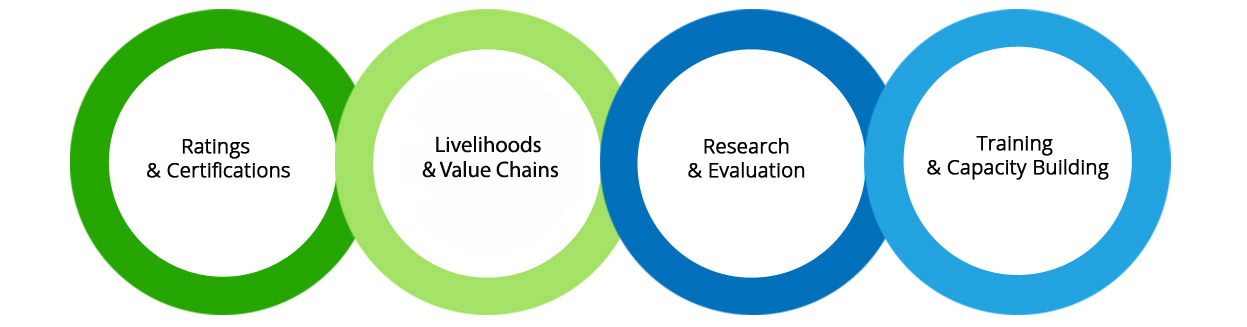

Financial services, value chains, inclusive business

Incorporating EDA Rural Systems

Workshop on ‘’Contemporary Issues related to FPOs” organized by FWWB, Ahmedabad on 29-30 October 2018

Ashok Kumar, Executive Director, Livelihoods & Value Chains, M-CRIL and a renowned expert of the Farmer Producer Organisations/producer companies (FPO) and livelihoods sector was invited to present on‘’M-CRIL’s FPO Rating & Assessment Tools’’ at a workshop on ‘’Contemporary Issues related to FPOs” organized by FWWB, Ahmedabad on 29-30 October 2018. At the same workshop, he was also invited to participate in a panel discussion on ‘’FPO governance and compliances’’.

[read more=”Read More” less=”Read Less”]

In addition to explaining the FPO rating & assessment framework designed by M-CRIL, Ashok shared key findings and issues based on experience of ratings/assessment of 20 FPOs undertaken by M-CRIL, including some of the largest FPOs across India. Amongst several aspects, the presentation recommended the way forward to make FPO ratings as a standardized tool to assess FPOs to help ease their access to loans from commercial banks, development finance banks and NBFCs. Additionally, the rating and assessment exercise identifies specific areas of weakness that the concerned FPO can focus on to improve its performance.

[/read]

M-CRIL’s role in The Global Microscope 2018 on Financial Inclusion

The latest Global Microscope report 2018 by The Economist Intelligence Unit has been released. This is a compendium on the state of financial inclusion in 55 countries that have been benchmarked and ranked. M-CRIL has contributed to the benchmarking of the regulatory and operational environments in 9 of the 55 countries. This contribution entailed detailed research on policy and regulations as well as interviews with government officials, regulators, heads of financial institutions and other stakeholders such as digital financial service providers. For this purpose, M-CRIL was able to leverage its extensive experience of the financial sector in multiple countries of Asia and Africa.

For the latest 2018 report please click here

Workshop on “Multiple Borrowing and Indebtedness In Myanmar”

Sanjay Sinha, MD, M-CRIL and renowned expert of the MFI sector in Asia was invited to present the key note address at a workshop on” Multiple Borrowing and Indebtedness In Myanmar” organized by Cordaid Netherlands, Myanmar Microfinance Association (MMFA), ADA Luxembourg and UNCDF In Yangon, Myanmar on 08 October 2018.

He presented the findings from a survey and analysis carried out by M-CRIL of multiple borrowing amongst MFI clients in 5 regions of Myanmar. Amongst other findings, the presentation highlighted concerns about the role of the number of loans per client rather than the absolute loan outstanding per client, from both MFIs and client perspectives vis-vis repayment difficulties. Recommendations arising out of the study were also presented to microfinance stakeholders for their consideration. For more interesting insights on this topic , please click here

Subscribe to our mailers for latest updates