Currently, this is the great dilemma in microfinance: is it beneficial to provide access to micro-credit (and incidentally other services like micro-deposits, micro-insurance and financial as well as digital literacy) for low income households across the world or is it harmful because people with marginal resources are tempted to obtain credit from multiple sources and, thereby, fall into a debt trap? The issue here is, are poor people’s lives facilitated by microcredit or is it a cause of further immiserisation resulting from the availability of easy money?

This document, "The dilemma in 21st century microfinance" is based on M-CRIL’s extensive experience of microfinance in Asia over the past 30 years.

We look forward to your feedback/comments.

LinkedIn: https://www.linkedin.com/feed/update/urn:li:activity:7416447179990466561

For all the effort made to digitise financial services and to promote the use of digital financial services (DFS) there continues to be a major gap amongst the general public in understanding the manner of its use and the benefits that could be derived from these services. The gap is surprisingly wide for the better off sections of the population in India and is even worse for low income people with lower levels of education and higher risk perceptions. The attached document sets out the manner in which people are mystified by DFS and the type and intensity of effort needed to improve understanding. Accelerating the process of demystifying DFS for the whole population would bring major benefits in terms of income growth for individuals and through facilitation of microenterprises for the growth of the economy. This article concludes with what needs to be done. [This is an abbreviated and slightly revised version of the document shared by M-CRIL a couple of months ago].

Sathapana Bank Plc, Cambodia, obtained the Client Protection Certification aligned with the Cerise+SPTF CP Certification Framework. Congratulations to Sathapana Bank Plc for the Gold Level!

We are pleased to share that M-CRIL Limited has signed an agreement for the promotion of new FPOs under MOVCD-NER, Phase IV. The contract signing was attended by Ashok Kumar, Deputy Managing Director, M-CRIL and Rajesh Gupta, Project Manager, M-CRIL. The contract was signed by Mr Jigme Dorjee Bhutia (IAS), Agriculture Secretary of the Agriculture Department on behalf of the Government of Sikkim and Ashok Kumar, on behalf of M-CRIL. Dr. S. Anabalagan (IFS), CEO of Sikkim Organic Farming Development Agency (SOFDA), and other department officials were also present at the signing. The assignment will entail the mobilisation of farmers into Farmer Producer Organisations. With these new FPOs, M-CRIL has so far promoted 21 FPOs in Sikkim under MOVCD-NER.

The Cambodia microfinance sector has been under the spotlight of the international media and investors in recent years. It is accused of aggressive lending leading to coercive behaviour towards poor clients causing landlessness and suicides. Based on its recent impact assessment study of Cambodian microfinance, M-CRIL has written two advisory notes: Note-1 examines the validity of some of the sensational international headlines; Note-2 highlights key weaknesses of the sector and proposes measures for the reform of microfinance in Cambodia.

Click here to read Advisory Note-1.

Click here to read Advisory Note-2.

In late 2022, Cambodia Microfinance Association (CMA) commissioned M-CRIL Limited to conduct an independent impact assessment of the microfinance sector in Cambodia. This study, the first of its kind in the country, draws on survey responses from over 3,200 #microfinance client households and 40+ qualitative interactions across 10 provinces and more than 450 villages in the country. The survey was undertaken in January-February 2023 and analysis, report writing and revisions took place mainly up to August 2023.

CMA hosted an in person and virtual conference for stakeholders on 19 January 2024 at the Center for Banking Studies (CBS), Phnom Penh to disseminate the results.

Sanjay Sinha, Co-Founder & Managing Director, M-CRIL and team leader for this impact assessment study presented the key findings during the event with remote support from India by Ratika Kathuria, AVP, Research and Evaluation, who was the Research Manager for the study. We gratefully acknowledge the support of the field team of enumerators and supervisors, M-CRIL’s team in Cambodia (Sengdy Khiev and Country Manager, Shayandeep Chakraborty), data management support by Analysts in India (Arpana Gone, Shwetangi Raj and Rejoice Parackal) as well as ongoing inputs and advice on methodology from M-CRIL’s co-Founder and Director Frances Sinha.

M-CRIL thanks CMA – Chairman Sok Voeun, Secretary General Phal Vandy, and Head of Financial Inclusion and Social Impact Pheakyny Vong – for commissioning the study and the CMA Board for their comments on various versions of the report.

The report is now public and available at https://cma-network.org/km/information-center/cma-publication/

We hope and expect that the report will make an evidence-based contribution to the controversies around the performance and approach of Cambodian MFIs towards lending to low-income families and create a better understanding of the nuanced impact of microfinance on micro-borrower households in the country.

Here are some glimpses of the event.

M-CRIL is currently undertaking a nationwide impact assessment study of microfinance in Cambodia, commissioned by the Cambodia Microfinance Association. The study includes a sample survey of borrowers in 10 selected provinces covering all the regions of Cambodia, focus group discussions and individual case studies. Our impact assessment report will be based on these field studies and M-CRIL’s experience of undertaking detailed studies of Cambodian microfinance institutions as well as of other development activities in the country over the past 20+ years. We hope and expect to make a knowledge-based contribution to the controversies around the performance and approach of Cambodian MFIs towards lending to low income families in the country.

In the meantime, please see the article in The Diplomat magazine (link below) in which our MD Sanjay Sinha has been quoted extensively but, in the context of the ongoing impact assessment, all the quotes here are non-controversial – we carefully avoided anything that could be misunderstood at this point and the data provided is simply based on a compilation of data from annual reports of 9 of the largest microfinance lenders in Cambodia.

The Diplomat is a current affairs magazine focused on the Asia-Pacific region

Please follow the link to read the article, 'Western Investors Are Losing the Ability to Shape the Future of Cambodian Microfinance’ – The Diplomat

The Board of Directors has re-appointed Sanjay Sinha, with over 40 years experience in the livelihoods and inclusive finance sector, as the Managing Director of M-CRIL from 01 December 2022.* This is expected to be temporary, for not more than 12-18 months, until an MD who combines domain expertise with leadership skills is appointed to lead our strong and experienced team, who fulfil M-CRIL’s mission of being:

“A high quality provider of analytical, advisory and promotional services to institutions and programmes working for inclusive growth, contributing to the economic and social development of low-income families”

Our mission is based on our values of dedication to inclusive, responsible growth for poverty reduction and gender equity with a professional commitment to integrity, quality and the highest standards of work – operating across Asia and Africa.

The substantial engagement of Mr Sinha as MD over the next year or so, will support further transition in the leadership of the company, paving the way to his eventual retirement from operations, when he aims to continue to apply his expertise in analysis, research and writing for inclusive growth.

The Board notes with thanks the contribution made over the past 4 years to the evolution of M-CRIL, by our outgoing MD, Ms Arpita Pal Agrawal who is continuing her development journey from PwC, to join an impact investment company.

* The appointment was approved at the M-CRIL Board’s meeting in September 2022 to ensure that there was no vacuum after the departure of Arpita P Agrawal from the company.

Fusion Microfinance Limited, India obtains the Client Protection Certification under the new methodology approved by SPTF-Cerise. Congratulations to Fusion Microfinance for the gold level!

World Water Week 2022 on the theme, ‘Seeing the Unseen: The Value of Water’ organised by Stockholm International Water Institute (SIWI) takes place from 23 August to 1 September. The first three days are online - https://lnkd.in/dmnZviw

M-CRIL represented by Frances Sinha is joining a panel organised by Aqua for All, with the National Bank of Kenya, Sidian Bank, WaterEquity, to discuss ‘Scaling access to water and sanitation through local financial institutions’

Session description: Private investments are needed to step in the significant investment gap for water and sanitation services. Financing through loans has the potential to provide flexibility and increase funding options for WASH service delivery. The session aims to showcase the route of local commercial finance for SDG6 impact.

M-CRIL’s panel contribution is to discuss experience with impact monitoring of a WASH portfolio.

Speakers:

CreditAccess Grameen Limited, India obtains the Client Protection Certification under the new methodology approved by SPTF-CERISE. Congratulations to CreditAccess Grameen for the gold level!

“The interest rates charged by Grameen are amongst the lowest in the industry and with high customer retention, it continues to adhere to the RBI regulations and the various guidelines of the Client Protection Framework. The company’s longstanding commitment to consumer protection is much appreciated.” Hema Bansal, Executive Director – Inclusive Finance, M-CRIL Limited.

Please follow this link to read the media coverage - https://lnkd.in/ddQ_fSkB

M-CRIL facilitated the participation of four progressive farmers of different Farmer Interest Groups (FIGs) from South and West Sikkim promoted by M-CRIL under Mission Organic Value Chain Development for North Eastern Regions (MOVCDNER) Phase III, in a day long workshop and exposure visit on "Advance Technology in Organic Farming" organized by the Centre of Floriculture & Agri Business Management (COFAM) Department of Biotechnology, University of North Bengal India. The workshop was meant to improve the knowledge of participants on organic farming of Strawberry, Kiwi and Dragon fruit. The enhanced knowledge is likely to contribute towards the cultivation of such crops in the region.

M-CRIL’s Dr Hema Bansal (Executive Director, Inclusive Finance), was honoured to be a part of the expert panel at the Asia Financial Institutions Forum (AFIFORUM) held on 15 March, 2022. At the forum Hema shared her insights from FMO project titled ‘Client protection in a Digital Age’ and highlighted how the assessment frameworks need to pivot while assessing or technical assistance to Digital Financial Service (DFS) Providers. Going forward while working with DFS providers, M-CRIL will primarily spend initial time in unbundling complex DFS models based on the products offered, technology used, partnerships forged and usage of data. The SPTF-CERISE developed DFS standards shall be used to conduct Fintech assessments however, care will be taken to ensure that the standards are applied in a calibrated manner based on size and business model. This year's edition was being attended by a wide variety of financial institutions from Asia and their investors from across the world.

Please watch this space for the recording of the event.

Arpita Pal Agrawal, Managing Director, M-CRIL was honoured to be part of the expert panel for the Leadership Summit 2022, organised by the Amity Global Business School session on “Skilling, Re-skilling and Up-skilling: The Future of Work” held on 25 February 2022. Arpita was joined by co-panelists Mr Anil Bhasin ex-President (Havells), Mr Rajeev Leekha, Partner, Complus Asset Management, Dr Aquil Busrai, Ms. Bhuvana Subramanyan, Chief Marketing Officer, Randstad India and Ms Pavithra Sanjeevi Sanjeevi CEO, Sri Venkatramana Paper Mills Pvt Ltd. It provided an excellent opportunity for the students to interact with the CEOs and leaders from India and abroad and to appreciate the need to proactively skill themselves to remain relevant in the workforce.

M-CRIL Director & Co-Founder Sanjay Sinha was honoured to be a part of the expert panel for the Second Dialogue in the series on "Challenges and Opportunities in managing climate risk & adaptation measures for MFIs and NBFCs" with the support of GIZ India. The event organized by Friends of Women's World Banking (FWWB) also has an enriching and inclusive panel discussion involving CEOs, MDs, EDs, and Founder leaders from NBFC and MFI Industry.

Please watch this space for the recording of the event.

M-CRIL's Executive Director - Inclusive Finance, Hema Bansal's paper on "Responsible Finance Mitigating Consumer Risks in a Digital Age: Recommendations for Funders" has recently been published by FMO - Dutch entrepreneurial development bank. The paper has been co-authored by IsabelleBarrès. M-CRIL will also be incorporating the learning in its future assessments and certifications for Fintech Companies.

With the sharp uptick in digital financial services across emerging markets, how can responsible funders and stakeholders best mitigate consumer risks?

FMO wanted to better understand the risks consumers face in the accelerated financial landscape, such as data theft and privacy loss. To do so, FMO commissioned experts to help them research and provide actions stakeholders can implement directly. FMO will also be integrating the guidance and recommendations into their own consumer protection framework.

Read the full report here

Congrats to Sathapana Bank Cambodia who obtains the Client Protection Certification under the new methodology approved by SPTF-CERISE. Sathapana reached the silver level of achievement!

M-CRIL MD Ms Arpita Pal Agrawal was invited to be the Lead Discussant on the research on Impact of Financial Inclusion on Household Coping Mechanisms based on SEPRI data and its implications for practitioners and policy makers. Financial Inclusion for Rural Transformation (FIRT) is a joint research initiative by IIMA-IRMA-BII to understand how policy and product design can amplify the impact of financial inclusion on rural households. Dr. Michael D. Patra, Deputy Governor, Reserve Bank of India (RBI) delivered the keynote address on financial inclusion & monetary policy at the launch event on 24 December 2021.

M-CRIL MD, Ms Arpita Pal Agrawal, was honoured to be part of the esteemed panel for the session on Mass Market Digital Lending - Emerging Trends & Perspectives on 15 December 2021 at the Inclusive Finance India Summit 2021 and discussed key issues on the subject with the panel. This annual event is being organised by ACCESS Development Services and co-hosted by NITI Aayog, the apex public policy think tank of the Government of India

Event Date & time: 15 December 2021, 12:50-14:10 hrs IST

Please follow this link to view the recorded version of all the sessions in the Summit.

M-CRIL MD, Ms Arpita Pal Agrawal was the speaker on the recently concluded Asia and the Pacific Regional Dialogue on Digital Transformation: Gearing Up for Inclusive and Sustainable Development on TSDSI: Digital Technology Innovations Series Webinar#3: "FinTech Advancements with 5G". She shared her views along with an esteemed panel discussing relevant aspects on the subject. The event was being organized by ITU.

Event Date and Time: 10 December 2021, 11:00 hrs GMT+7 (Bangkok time)

Relevance of a Sustainability Framework for Farmer Producer Organisations (FPOs) and how the ecosystem could contribute to facilitate its adoption. M-CRIL MD, Ms Arpita Pal Agrawal was part of these pertinent roundtable deliberations with the experienced panel.

Please visit our LinkedIn page to view more https://www.linkedin.com/feed/update/urn:li:activity:6859447942701490176

Event Date and Time: 28 October 2021, 11:45-13:15 IST

About the change, our co-Founder Sanjay Sinha writes, “The time has come for me to substantially reduce my engagement in M-CRIL and formally hand over the operations of the company to a younger person. The aim is to give myself some time to relax as well as pursue other interests after 38 years of being fully engaged in the management of EDA Rural Systems and then M-CRIL. Equally, importantly, the aim is to allow space for Arpita, who is taking over from me, to take the initiative in moving the company forward and to enhance M-CRIL’s considerable contribution to economic and social development in India, Asia, Africa and elsewhere.

Arpita has been with M-CRIL as CEO for over three years now and is fully engaged already in the management and business operations of the company. Her experience in this field with major international consulting organisations has been a great asset and, both M-CRIL’s Board as well as Frances and I, as founders, believe she will be able to take the company forward with initiative and dynamism. She along with M-CRIL’s senior management team and all team members, will be working to fulfil M-CRIL’s mission of being…

A high quality provider of analytical, advisory and promotional services to institutions and programmes working for inclusive responsible growth, to contribute to economic and social development opportunities for low income families.”

As Directors and co-Founders of the company Sanjay Sinha & Frances Sinha will continue to engage with and contribute to the work of the company when required.

M-CRIL is honoured to be facilitated by the Farmer Producer Organisations #FPOs of South Sikkim promoted under the scheme ‘Mission Organic Value Chain Development for North Eastern Region’ Phase I in Namchi, South Sikkim. M-CRIL have promoted and formed 9 FPOs in South Sikkim since January 2017 till December 2020. The executive body of all the 9 FPOs have presented a letter of appreciation to recognise the efforts of our team members in nurturing them towards their journey in becoming self-managed professional registered farmer orgnisations serving their members effectively by linking them with national and international markets for their produce.

M-CRIL and EDA have worked with value chains that engage low income families, farmer organisations, agri-enterprises and on financial structures for supporting smallholder agriculture for over 40 years. We have unparalleled research experience and are an acclaimed innovator in this field along with our work in microfinance. On account of our prominent and extensive parallel work in inclusive finance, the work with agri-enterprises and farmer cooperatives/producer organisations (FPOs) is less well known.

The attached document is aimed at redressing the imbalance. Please have a look and address queries to ashokkumar@m-cril.com and arpita@m-cril.com.

Please click here to download the VC & FPO handout.

Sanjay Sinha, MD, M-CRIL is honoured to be part of the Jury Panel for TheCSRUniverse COVID Response Impact Awards 2021, to find best COVID-related initiatives which made significant contribution to emerging social needs amidst the COVID pandemic. The distinguished panel includes top academicians from premier institutes like IIMs, IRMA, TISS and renowned CSR experts

The power-packed jury panel for selecting the best social projects includes Dr Rishikesha T Krishnan, Director, Indian Institutes of Management (IIM) Bangalore; Dr Himanshu Rai, Director, Indian Institutes of Management (IIM) Indore; Dr Umakant Dash, Director, Institute of Rural Management Anand (IRMA); and Prof Shalini Bharat, Director, Tata Institute of Social Services (TISS), Mumbai.

In addition to the top academicians, the renowned social sector experts in the jury panel include Mr Joseph Nixon, Ex-President & Chief Operating Officer, SBI Foundation; and Mr Sanjay Sinha, Managing Director, M-CRIL.

Read moreThe RBI’s consultative document on the regulation of microfinance released on 14 June 2021 is a welcome initiative that gives serious consideration and takes an analytical approach to the issues affecting microfinance lending in India. In this commentary M-CRIL sets out the proposed new regulation briefly and makes an alternative suggestion.

M-CRIL recently announced a series of online training courses to strengthen staff capacities, improve efficiency and profitability of MFIs.

As part of this series, M-CRIL is pleased to announce an online training course on Risk Management for MFIs (in English) scheduled during 23-25 June 2021.

Click link to Register for the online training on Risk Management for MFIs https://lnkd.in/gtsQy7P

We will continue to celebrate the life of Dr Shahid Perwez through a set of videos that we have uploaded through the YouTube Channel Playlist titled , ‘Remembering Shahid’ - https://youtube.com/playlist?

M-CRIL Card for Shahid's family with our heartfelt thoughts - a small memento to comfort them during this difficult time.

We are living with a stream of harrowing news. Every cry for oxygen, every notice of a death arouses the sympathies of us all. But sometimes, one you don't expect hits you harder than the others. Shahid Pervez, who courageously researched 'death before birth' in Tamil Nadu for his PhD and carved out a career as a social researcher committed to making his work contribute to improving people's lives, died from covid earlier this month, leaving a home-maker wife and three small kids.

In his memory, we invite you to a virtual meeting on 27 May 2021, at 18:30 IST, 14.00 UK. We will send out the zoom details next week.

We have also set up a GoFundMe appeal (https://gofund.me/9a9c2220) and a Crowdera appeal for those living in India – https://gocrowdera.com/shahidperwez. The funds raised will be used to support the education of Shahid’s three children. Depending on the funds contributed, they may also be applied to support employment for Neha to help her rebuild her life with dignity.

We hope you can join us to recall stories about Shahid and to share our support for his young family.

Do let us know if you would like to speak at the meeting. Or would like to send something written or on video in advance.

Chhimek Laghubitta Bittiya Sanstha Ltd., a listed microfinance bank in Nepal has been SMART-Certified on the client protection principles. M-CRIL congratulates Chhimek for its commitment to client protection principles.

Sahara Nepal Bachat Tatha Rin Sahakari Sanstha Ltd., a microfinance cooperative based in Nepal has been SMART-Certified on the client protection principles. M-CRIL congratulates Sahara for its commitment to client protection principles.

Mohanokor Microfinance Institution Plc., an MFI based in Cambodia and a member of Cambodia Microfinance Assosication (link), has been SMART-Certified on the client protection principles. M-CRIL congratulates Mohanokor for its commitment to client protection principles.

Kisan Bahuudeshiya Sahakari Sanstha Ltd., a microfinance cooperative based in Nepal has been SMART-Certified on the client protection principles. M-CRIL congratulates Kisan for its commitment to client protection principles.

Unique Nepal Laghubitta Bittiya Sanstha Limited (Unique) has become the first MFI in Nepal to be SMART-Certified on the client protection principles. M-CRIL congratulates Unique for its commitment to client protection principles.

In these tragic, difficult times of COVID, we are shocked and deeply saddened that our dear colleague Dr Shahid Perwez has passed away.

Shahid completed his Ph D in Sociology and Social Anthropology in 2009 at the University of Edinburgh, was associated with universities in India and in the UK, and joined the Research and Evaluation division of EDA Rural Systems/M-CRIL in 2016. Since 2018 he has led the team – a keen researcher, team builder and conscientious teacher.

We miss you Shahid – colleague, friend, family man.

Please keep Shahid's family in your thoughts as they go through this difficult time, dear Neha, Ashaz, Hammad and little Inaaya.

Mitra Bisnis Keluarga (MBK), one of the largest microfinance institutions in Indonesia with a 50% shariah compliant portfolio, continues to remain certified on the client protection principles by getting SMART-Certified a second time. M-CRIL congratulates MBK for its continued commitment to client protection principles.

AMK Microfinance Institution Plc, a leading microfinance deposit taking institution in Cambodia, with a strong focus on social impact has reaffirmed its commitment to client protection principles by getting SMART-Certified a second time. M-CRIL congratulates AMK for continuing to place clients at the centre of its operations.

Satin Creditcare Network Limited, one of the largest microfinance institution (NBFC-MFI) in India, continues to remain certified on the client protection principles by getting SMART-Certified a second time. M-CRIL congratulates Satin for its continued commitment to client centricity.

M-CRIL Managing Director, Sanjay Sinha contribute to the opening plenary of European Microfinance Week 2020 covering Institutional Resilience and the Status of the Sector as it works its way through the Covid-19 pandemic. The session summary in the conference report shows how the sector has been remarkably resilient despite the challenges of the pandemic but the inputs of Greta Bull of CGAP, Eric Campos of Grameen Credit Agricole, Mohammed Khaled of IFC and Sanjay Sinha indicate that while liquidity has undoubtedly been a challenge, it has not caused as much of a problem as was initially feared. M-CRIL's analysis of MFI liquidity in 5 Asian countries indicates, however, that the challenge may be a long rather than a short term one as the portfolio quality issues resulting from repayment moratoria and business crises faced by clients will take years to resolve. While increasing digitisation will enable greater efficiency it also carries the danger of excluding the poorest who are least likely to own smartphones and also unlikely to be sufficiently digitally aware to benefit from this technical evolution of the sector.

M-CRIL recently announced a series of online training courses to strengthen staff capacities, improve efficiency and profitability of MFIs in Myanmar.

We are pleased to announce the 2nd online training in the series on 𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝗹 𝗔𝘂𝗱𝗶𝘁 𝗮𝗻𝗱 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗦𝘆𝘀𝘁𝗲𝗺 (English & Myanmar) scheduled during 3-5 February 2021.

Registration Link and Course Fee Payment Details: https://lnkd.in/eMxT3Vb

We have rebranded ourselves as M-CRIL Limited dropping the full form Micro-Credit Ratings International Limited.

We have adopted this name change to reflect our gamut of work aimed at supporting inclusive and responsible growth. Please be assured that the quality of our services will continue to be of the highest achievable standard, as it’s only a name change!

Amret, one of the leading MDIs in Cambodia, reaffirms its commitment to client protection principles by getting SMART-Certified a second time. M-CRIL congratulates Amret for continuing to maintain its focus on client centricity.

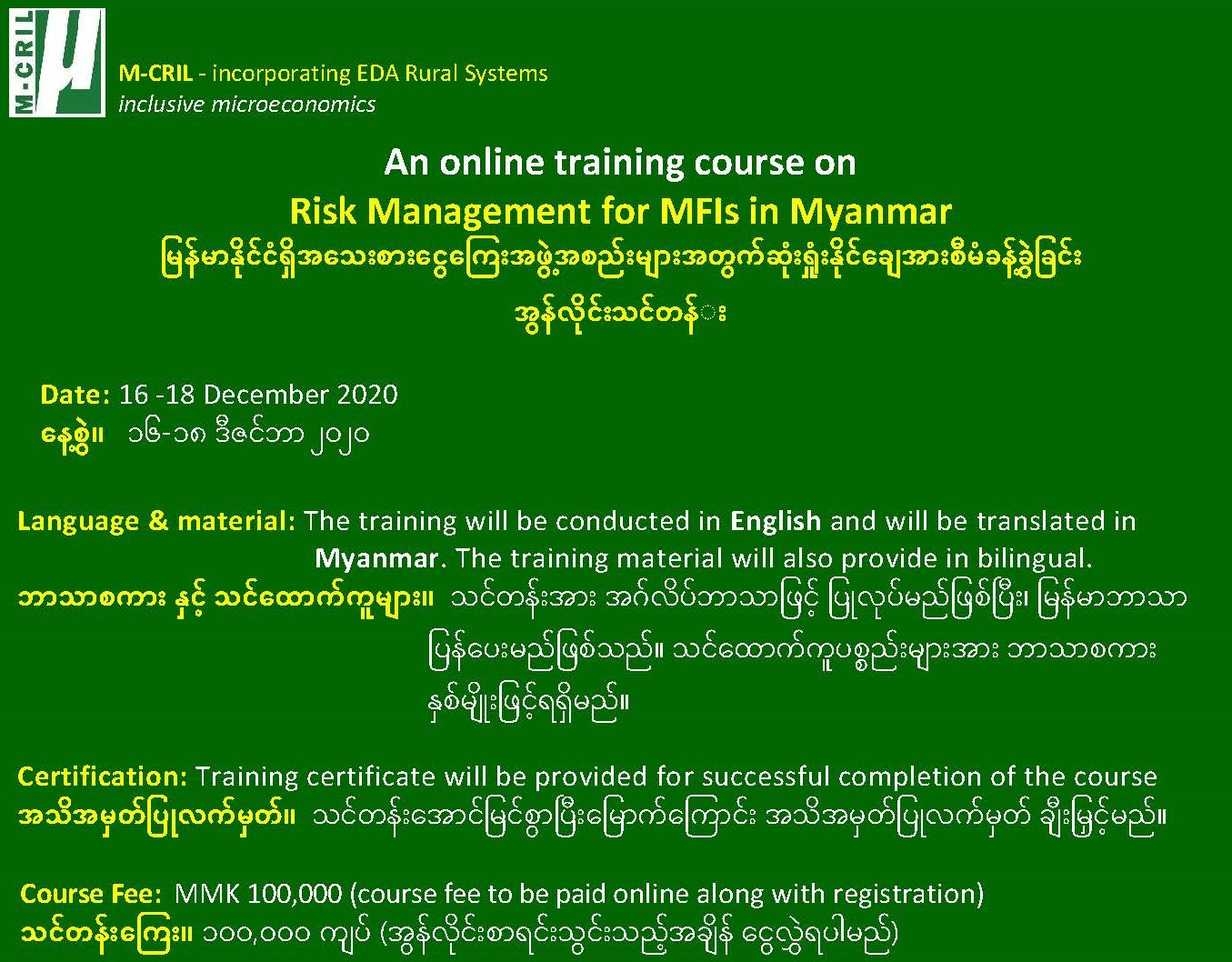

M-CRIL announces a series of online training courses to strengthen staff capacities, improve efficiency and profitability of MFIs in Myanmar.

The first in the series is an online training course on Risk Management for MFIs in Myanmar (English & Myanmar) scheduled from 16-18 December 2020.

Link for Registration and Course Fee Payment Details: https://lnkd.in/esM_YPH

M-CRIL recently assisted in a Marketing Strategy review for Pact Global Microfinance Fund (PGMF) , the largest MFI in Myanmar covering their clients, staff and community members. As a follow-up to the project it conducted an online training to PGMF senior managers on ‘Marketing Strategy and Managing Clients & Staff Retention’. The training also covered topic of Managing Staff & Clients during crisis like COVID-19.

M-CRIL is helping carry out a financial services demand side survey in Fiji whose findings will aid monitoring the progress of its National Financial Inclusion Strategy 2016-2020 and set new targets for financial inclusion for the next five years. Its being undertaken for the UNDP - in close partnership with Reserve Bank of Fiji, Fiji Bureau of Statistics, Alliance for Financial Inclusion, and the Pacific Financial Inclusion Programme in the South Pacific Region.

We have managed to resume conducting fieldwork last month, using a ‘hybrid approach’. Undertook week-long classroom Training of Trainers(ToT) & field practice environment using Zoom, followed by another week of virtual facilitation & monitoring of Enumerators' Training. Face-to-face field interviews have now been actively rolled out with real-time monitoring by our team remotely from India. Quality assurance is key to the exercise and we are being supported by our technology partner SurveyCTO with appropriate technology and support for virtual data monitoring.

As the COVID-19 fallout on businesses and economies continue, a critical part of the MFI sector efforts to cope with the scenario is enabling digital payments (disbursements and collections) for their customers.

SPTF and M-CRIL have come together to help facilitate this process by organising an online training session to enable MFIs to adopt low-cost, efficient and customer-centric digital payments. The online training session was conducted on 6th August 2020 with an overwhelming response from 300+ participants.

The Advisory Note “Liquidity in lockdown – Update 2: India’s SFBs & MFIs coping with the pandemic” authored by Sanjay Sinha draws attention towards the challenges along the micro-lending value chain for Small Finance Banks (SFBs), MFIs and NBFCs. Wholesale lending by Banks needs to shed their conservatism and step up with a dynamic response to the current situation.

The effect of lockdown due to COVID-19 has emerged as a formidable challenge for farmers, including Farmer Producer Organisations (FPOs) and their activities, businesses and governments globally. COVID-19 is literally changing everything about us including how we will undertake and manage agriculture and its support ecosystem.

The purpose of this Webinar is to facilitate an exchange of ideas on how the sector in general and FPOs, in particular, have leveraged relationships, networks and resources to turn the COVID-19 crisis into an opportunity.

Please click here for more details

Please click here to register. Registration is free of cost.

As the events surrounding COVID-19 unfold, the M-CRIL team is committed to delivering thoughtful analysis and resources that will help the inclusive finance and the livelihoods ecosystem to navigate the current uncertainty and disruption, including in the field research. We aim to help research organisations, financial inclusion and livelihood ecosystem stakeholders, and development community deliver services sustainably and at the same time assist their clients/users to cope better with the financial stress and changing on-ground situation in this challenging time.

To facilitate this, M-CRIL is conducting a series of webinars to bring together the inclusive finance and livelihood ecosystem stakeholders in the Asia region with the objective of discussing and sharing experience and practice/s that stakeholders can learn from, modify and adapt to their respective country contexts.

This is the third seminar in the series.

In this edition, we look at challenges and practical actions in ‘field research’ in situations of social distancing under lockdown.

Click here for Key Takeaways from the webinar

Click here to view the recording of the webinar

As the events surrounding COVID-19 unfold, the M-CRIL team is committed to delivering thoughtful analysis and resources that will help the inclusive finance ecosystem to deal more effectively with the current uncertainty and disruption. We aim to help financial inclusion providers deliver services sustainably and at the same time assist their clients to cope better with the financial stress at this challenging time.

To facilitate this, M-CRIL is conducting a series of webinars to bring together the inclusive finance ecosystem stakeholders in the Asia region with the objective of discussing and sharing experience and practice/s that stakeholders can learn from, modify and adapt to their respective country contexts. This is the second seminar in the series.

In this edition we look at the emerging model of Digital Lending and its coping strategies.

Click here for Key Takeaways from the webinar

Click here to view the recording of the webinar

As the events surrounding COVID-19 unfold, the M-CRIL team is committed to delivering thoughtful analysis and resources that will help the microfinance ecosystem to deal more effectively with the current uncertainty and disruption, both internally and for their clients. To facilitate this, M-CRIL proposes to conduct a series of webinars to bring together the microfinance ecosystem stakeholders in the Asia region with the objective of discussing and sharing experience and practice/s that stakeholders can learn from, modify and adapt to their respective country contexts.’’

Click here for Key Takeaways from the webinar

Click here to view the recording of the webinar

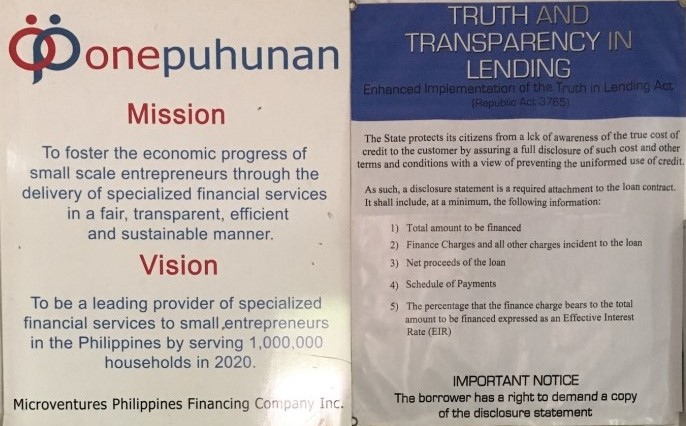

M-CRIL is pleased to share that OnePuhunan, Philippines has successfully completed the CPP Surveillance Audit and has reaffirmed its commitment to Client Protection. It has also implemented client friendly measures to allow flexible repayment of loans to clients who have been effected by the precautionary lockdown to stem the spread of COVID-19.

We are extremely pleased to share that Lamaten Tingmoo Organic Growers Cooperative Society Limited, an FPO promoted by M-CRIL in South Sikkim with support from Small Farmers’ Agribusiness Consortium (SFAC) was chosen to be part of the successful ‘’Launching of 10,000 FPOs in India” at Chitrakoot, Uttar Pradesh on 29 February 2020 by Hon’ble Prime Minister of India Narendra Modi). PM Modi visited the stall of the FPO where he was handed a traditional Nepali topi and traditional Lepcha dress of Sikkim as a token of our gratitude.

M-CRIL congratulates SEF for getting SMART Certified and reinforcing their commitment to Client Protection. This is the first certification in South Africa and M-CRIL hopes that it will inspire other financial institutions in South Africa to apply for the client protection certification

M-CRIL’s CPP Lite is recognized by the Smart Campaign as a helpful stepping stone to help prepare institutions for a Smart Assessment or Smart Certification.

In response to market interest from regulators, microfinance networksand smaller financial service providers, M-CRIL has developed the CPP Lite Introductory Qualification which draws on M-CRIL’s engagement with the Smart Campaign and its longstanding experience in ratings and assessments

The CPP Lite tool focuses on a core set of sub-indicators and compliance criteria of the client protection. This phased approach provides a pragmatic framework for MFIs to strengthen their systems incrementally, and allows public acknowledgement that such institutions are on the path to full CPP compliance.

M-CRIL has been licensed by the Smart Campaign as a certifier since 2013. The Smart Certification program has established the importance and credibility of the seven Client Protection Principles in financial services delivery. Over 120 institutions globally have achieved Smart Certification. Many more FSPs are interested but are looking for a phased approach to become compliant due to size or resource constraints.

We continue to build capacity in the microfinance ecosystem in Myanmar - Conducting a Training programme on ‘’Strategic Business Planning’’ for senior manager of MFIs in Yangon between 24-27 February. This is jointly organised with The Myanmar Microfinance Association (MMFA).

Dr Shahid Perwez, delivered the Keynote Address on "Political Economy of Public Health Research in India" at the 7th Annual National Conference of All India Association of Medical Social Works Professionals, 2020 held at the Regional Institute of Medical Sciences (RIMS) at Imphal, India during 6-7 February 2020. He highlighted the need for a focus on comprehensive disease prevention and rehabilitation with the contribution of social scientists and medical social work professional. He also emphasized need for further research on dealing with challenges of grossly under-reported mental health issues, which are linked with poverty and social exclusion.

M-CRIL, in association with The Myanmar Microfinance Association (MMFA), recently undertook capacity building of MMFA members in the area of Risk Management. The 4 day training conducted for senior managers focussed on an overall approach to risk management and risk reporting covering Credit risks, Operational risks, Financial risks etc.

M-CRIL is pleased to provide consultation to Indian Institute of Entrepreneurship (IIE) Guwahati and Oil Jeevika - a CSR Project of Oil India Ltd, to improve the project implementation of Honey project in Arunachal Pradesh, India. An event was organised recently to provide training and distribute Bee boxes & Bee colonies to entrepreneurs. The event was extensively covered by a regional news channel - https://lnkd.in/eYBRePt

M-CRIL is pleased to facilitate a Exposure tour of India for the Myanmar Microfinance Association (MMFA) to understand the Indian MFI growth story and its opportunities & challenges. Meetings with the RBI, NABARD, SROs, Credit Bureaus, MFIs and SFBs are planned.

M-CRIL is pleased to be have been associated with the Global Microscope 2019. M-CRIL has been contributing to this annual Study since 2014. It is a compendium on the state of financial inclusion in 55 countries covering following five domains: Government and Policy Support, Stability and Integrity, Products and Outlets, Consumer Protection, Infrastructure.

This year’s MicroScope also focusses on the gender aspect of financial inclusion. Please click here to read the latest report.

M-CRIL represented by Arpita Pal Agrawal shared her views on emerging risks in the microfinance sector at the National Microfinance Congress 2019 organised by SIDBI(Small Industries Development Bank of India) at Mumbai.

M-CRIL represented by Achin Bansal participated in the discussion on "Digitization for Financial Inclusion" in the Annual Microfinance Conference (AMC) at Siem Reap, Cambodia on 22nd November 2019.

We are extremely pleased toshare that LamatenTingmoo Organic Growers Cooperative Societyan FPO in Sikkim, promoted by M-CRIL, has won the Jury Special Award at Samunnati- The Economic Times – Farmer Producer Organization Summit & Awards 2019 held in Delhi today.The FPO is focused on cultivation & market linkage of cherry pepper called “Dalley Khorsani’’.

M-CRIL is supporting FPO Lamaten Tingmoo Organic Growers Cooperative Society Ltd in South Sikkim in collectivization of cherry pepper & linkages with institutional buyers. The cherry pepper is widely known as "Dalley Khorsani" in Sikkim. The FPO is able to aggregate around 15 MT yearly collection in peak season from small and marginalised farmers in the difficult terrain of Sikkim.

Mr Ashok Kumar, Executive Director, M-CRIL (FPO rating and market led VC & livelihoods promotion expert) was invited as a panellist to a National Consultation organised jointly by NAFPO & SRIJAN on 12-13 September 2019 to identify gaps and brainstorm policy recommendations for the State of Assam with a key focus on access to finance for FPOs/producer companies, to ensure a supportive ecosystem for FPOs for their business growth.

He shared best practices adopted by FPOs across the county for building equity/capital and accessing finance from banks and NBFCs. He made suggestions that FPOs in North East could utilise schemes such as MOVCD-NER (Mission Organic Value Chain Development for North Eastern Region) and other Govt schemes to create capital, assets (including land & infrastructures) and leverage them for bank finance. He advocated the idea that FPOs should view themselves from banks’ lens/perspective to be able meet banks’ expectations related to financing.

M-CRIL is proud to have partnered with Pact Global Microfinance Fund (PGMF), Myanmar’s largest microfinance institution in capacity building of its Enterprise Team during August 2019 for ‘’Enterprise Loan Training for its Enterprise Managers & Loan Officers’’. With 20,000 enterprise clients, PGMF is increasingly focussed on micro and small enterprises (MSMEs) as a way to contribute to the economic growth, employment potential and equitable development in Myanmar.

We are pleased to share that Amret has successfully renewed its SMART Campaign Client Protection Principles (CPP) certificate, after receiving certification for the first time in 2016. The renewal of Amret’s certificate was announced on 19 February 2019 after the mid-term review by M-CRIL, one of the Smart Campaign auditors. Amret’s reaffirmed commitment to respect industry-accepted consumer protection standards demonstrates its continued focus on serving its target clients – micro, small and medium enterprises and low income people – responsibly.

We are pleased to share that AMK was awarded the Leader Milestone Certificate by Truelift and is the first institution in Cambodia to achieve this. M-CRIL completed a Truelift assessment of AMK operations as part of its social rating of AMK. With this AMK joins six other FIs globally as Truelift Leaders in microfinance. The Truelift Certification signifies AMK’s commitment to bring about positive and enduring change for people living in conditions of poverty.